UPM has successfully issued a new EUR 500 million green bond under its EMTN (Euro Medium Term Note) programme and its Green Finance Framework. The bond matures in May 2029 and pays a fixed coupon of 2.25%. UPM will apply for the bond to be listed on the Irish Stock Exchange plc, trading as Euronext Dublin.

Citigroup, Commerzbank, Crédit Agricole CIB, Nordea and Swedbank acted as Joint Bookrunners for the transaction.

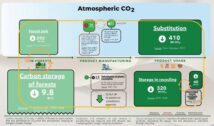

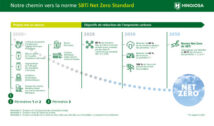

The net proceeds from the bond will be used for financing and/or refinancing of Eligible Projects and Assets under UPM’s Green Finance Framework established in November 2020. The indicative allocation of the framework categories to be used are climate-positive products and solutions, sustainable forest management and pollution prevention and control, including waste management.

“With the successful third issuance, UPM becomes one of the largest corporate green eurobond issuers in the Nordics with a total of EUR 1,750 million issued. We are once again delighted for the confidence and interest shown by the investors. This third green bond continues to support us in achieving our responsibility targets as defined in our Biofore strategy,” says UPM´s CFO Tapio Korpeinen.

The base prospectus, supplement to the base prospectus and the Green Finance Framework are available on UPM’s website at www.upm.com/investors/upm-as-an-investment/debt/.