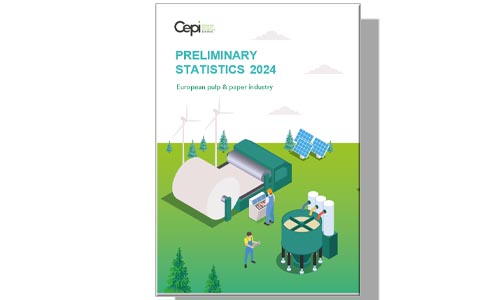

Tracking a global economy still recovering from successive shocks and post-Covid stock adjustments, Europe’s pulp and paper sector had a positive year in 2024, as shown by the Cepi preliminary statistics report published today. But looming global trade wars, geopolitical instability, and new EU energy and industry policies to be unveiled this month, hold the potential for profound impact.

Paper and board consumption increased by 7.5% in 2024 and production followed suite, growing by 5.2%, after two years of contraction. The sector was outperforming global competitors by a small margin, with global Paper Board production also recovering.

This only partly offsets a negative trend in 2023, where production fell by 13%, and it remains at far lower levels than before the Covid pandemic. Mirroring these trends, Paper for Recycling utilisation increased by 4.1% in 2024, after two successive years of decline, while still remaining lower than at its 2021 peak. It remains however at far higher levels than in the early 2000s, having grown by 5 million tonnes during this period despite the decreased consumption and production.

Correlated to the sector’s recycling performance, the increase was mainly driven by packaging, an engine of growth for the past decades. Production of packaging grades, high users of paper for recycling, has increased by 6.5% compared to 2023. It now accounts for nearly two thirds of total paper & board production, at 63.0%.

Demand for graphic paper, which includes newsprint and printing and writing paper, grew by 5.2% in 2024, its first year of expansion since 2010. The demand for tissue paper rebounded with a 5.8% growth rate. Energy prices remain two times higher than before the Covid crisis, weighing on European industry’s competitiveness, and especially on the most energy intensive grades.

High production costs, including energy, are currently at the heart of a debate, as the EU Commission prepares to publish new documents clarifying its plans to restore European manufacturing sector’s competitiveness and boosting circular economy and bioeconomy in a context where the European Union’s growth rates remain stubbornly below other advanced economies’ average. Production across all EU manufacturing sectors is still 10% lower than in 2021, with pulp and paper being no exception.

As trade tensions intensify, it is important to recall that the EU and the US have been large trade partners, benefiting from a relatively stable environment with no import tariffs on both sides for the past 20 years. Exports overall increased in 2024, notably by 16,8% with North America. Exports accounted for 21% of P&B production in 2024 and Europe’s pulp and paper’s global trade balance is by far positive, being one of the top EU manufacturing sectors by this measure. While the EU imports from the US a lot of pulp, it exports a lot of paper and board.

“In a cyclical industry, we see positive signs of growth in the pulp and paper sector. Whether this growth can be sustained depends in part on what EU Institutions will do to allow us to compete on an equal footing, not only with other pulp and paper producers in the world, but also with industries based on fossil materials.”

“The expected Clean Industry Deal, the Affordable Energy Plan and Bioeconomy Strategy, combined with advancing defossilisation, circular economy and simplification of EU regulation are elements that the pulp and paper industry now needs to get back to growth and investments in Europe.”Jori Ringman, Cepi Director General