In spite of the increasing uncertainties (conflict in Ukraine, energy markets, slowing growth, resumption of inflation), the French paper industry hopes to continue in 2022 the strong rebound in activity observed last year. The rebound in paper production in 2021 (+7%) has made it possible to erase the low point of 2020 (-6.1%). This was one of the key messages delivered by Copacel*, at its traditional press conference organized on 23March in Paris.

The exceptional growth of GDP in France and Europe in 2021 has had a knock-on effect on the consumption and production of paper products. The production of the paper industry (paper, board and market pulp) reached 7.4 Mt, which, due to the combined increase in volumes and sales prices, represents a turnover of 5.9 billion Euros, up 25% compared to 2020. This rebound concerned both paper and board for packaging (+9.7%) and for graphic applications (+8.7%). However, due to the near-stability of packaging paper and board production in 2020 (-0.4%) and the sharp drop in graphic paper production in the same year (-26.7%), the increase in volumes of this second grade of paper and board in 2021 will not be sufficient to offset the decline in production.

The increase in volumes of this second paper grade in 2021 does not modify a basic trend observed since the mid-2000s in the French and European paper industry (closure of capacity in the graphics segment accompanied by increases in the packaging segment). The hygiene paper sector, for its part, saw its production fall slightly in 2021 (-1.8%) but after a year of increase in 2020, so that the tonnage produced in 2021 is almost identical to that of 2019.

A year 2021 characterised by unexpected increases in production costs and significant extensions of delivery times for certain types of paper products

The succession of a recession in 2020, followed by strong GDP growth in 2021 in most countries, has resulted in a marked increase in raw material and energy costs. For the paper industry, this move has resulted in a sharp increase in the prices of recycled paper and board (+160% for recycled corrugated board in 2021 compared to 2020) and wood. In addition to this movement, there has been an unprecedented rise in the cost of energy since 2021. The prices of gas and electricity on the wholesale market have thus multiplied by more than 5 and 3 respectively (average 2021 compared to 2020). The combination of this explosion in production costs and a marked increase in demand has led to a successive increase in the selling prices of paper and board. This trend has been compounded by longer delivery times for several paper product families (graphic paper, board, flexible packaging, etc.). This is the result of balance between supply and demand on a European scale. In the case of graphic paper, this imbalance is the result of the conversion or shutdown of machines producing graphic paper in recent years, in order to adjust production capacity to a market that is still structurally growing.

The drivers for the development of the paper industry remain in 2022, but the multiplication of uncertainties makes projections difficult

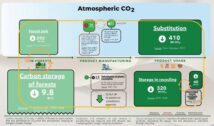

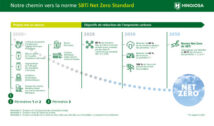

As the first quarter draws to a close, order books remain full for most paper products and the drivers of consumption are still present. Graphic paper producers are benefiting from a situation where the European production tool is under-capacity (which was not the case during the last 15 years). Companies manufacturing packaging paper and board continue to accompany changes in consumption patterns (development of e-commerce, replacement of single-use plastics). The hygiene paper segment is benefiting from a greater awareness of health issues, as well as from the fact that consumption points that are still under-frequented (hotels, airports, etc.) are expected to increase gradually. The publication in March by the paper industry of its de-carbonisation roadmap recalls the progress made and sets a clear course for the coming years. The use of local raw materials (wood, recycled paper and cardboard, etc.) limits the consequences of the conflict in Ukraine and allows the continued production of goods essential to the country’s life.

In spite of these advantages, several risks cloud the horizon, including: a more or less brutal decrease in consumption caused by the combination of inflation and the conflict in Ukraine, the maintenance of high energy prices, the increase in the price of various raw materials (starch, wood) as a direct consequence of the conflict in Ukraine, the persistence of logistical problems linked to an ever-prevailing negative impact on the economy. « The activity of the paper industry has been very good in 2021, and is well oriented towards the 2022 goal, explains Philippe d’Adhémar, President of Copacel (picture). However, the war in Ukraine, the risk of a worsening of the macroeconomic context and the persistence of extremely high energy and raw material prices could reverse the trend. For this key industry in the life of the country and emblematic of the circular economy, the future government will have to rapidly initiate public policies aimed at reducing these uncertainties, particularly in the area of energy supply. »

COPACEL (Union Française des Industries des Cartons, Papiers et Celluloses) is the trade union representing French companies producing paper and board. It brings together 72 companies, employing nearly 11,000 people, with a total turnover of nearly 6 billion euros.