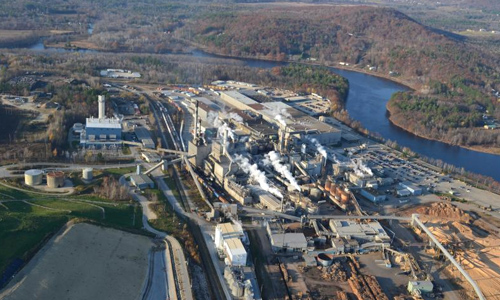

Verso Corporation today announced that it has entered into a definitive agreement to sell its Androscoggin mill, located in Jay, Maine, and its Stevens Point mill, located in Stevens Point, Wisconsin, to Pixelle Specialty Solutions LLC for $400 million, subject to post-closing adjustments.

The sale, which has been unanimously approved by the Company’s Board of Directors (the “Board”), is subject to and conditioned upon the receipt of approval from the Company’s stockholders at a special meeting of stockholders, as well as certain regulatory and other customary approvals. The transaction is anticipated to be completed in the first quarter of 2020.

Gene Davis, Co-Chairman of the Board, stated “We have undergone a thorough and comprehensive strategic process and firmly believe that the sale of these two mills at the agreed upon terms and conditions is in the best interests of the Company and our stockholders. We could not be more pleased by the efforts of the entire Senior Leadership Team and of Les Lederer, our Interim Chief Executive Officer since April.”

Net cash proceeds of the transaction are anticipated to be approximately $336 million, after the assumption by Pixelle of approximately $35 million of pension liabilities, anticipated working capital adjustments, and the payment of transaction related expenses. The Board intends to return a significant portion of the net proceeds to stockholders either by way of dividend or share repurchase, conducted either by way of modified Dutch tender offer, accelerated share repurchase program or open market purchases, and to determine and announce the amount and form of such return promptly following the closing of the transaction. In addition, Verso will utilize approximately $54 million of the net proceeds to reduce a portion of its unfunded pension liability. Any remaining net proceeds will be used for general corporate purposes while the Board continues its ongoing review of the Company’s strategic alternatives.

Verso today also announced that Adam St. John had been named as the Company’s Chief Executive Officer and appointed as a member of the Board. Mr. St. John has been Senior Vice President of Manufacturing for all Verso mills and a long-standing member of the Senior Leadership Team. Prior to joining the Company, Mr. St. John served in a senior management capacity at Georgia Pacific. Mr. Lederer will continue to serve as a Senior Transaction Advisor to the Company.

Alan Carr, Co-Chairman of the Board, further stated: “With almost three decades of paper industry experience and more than a decade of experience with Verso, we are confident that Adam is the right choice to lead the Company consistent with our strategic focus. Under Adam’s guidance, we expect that our remaining mills will generate sufficient EBITDA and cash flow to permit the Company to enhance its competitive market position, so as to create future growth and other opportunities.”

Houlihan Lokey acted as financial advisor and Akin Gump Strauss Hauer & Feld LLP acted as legal counsel to the Company in connection with the transaction.