An unprecedented study of 1,500 supermarket grocery products reveals the grip that plastic packaging has on food and beverage purchases. The “Material Change Index”, commissioned by DS Smith and conducted by Retail Economicsc (1), has identified that 40% of food and beverage products in French supermarkets are unnecessarily (2) packaged in plastic that can be safely removed or replaced with alternatives.

This mountain of plastic represents 27.3 billion avoidable pieces per year in France. The study shows that most of this plastic comes from packaging for meat and fish (82%); non-alcoholic beverages (75%); and dairy products (71%).

A European survey of food manufacturers and retailers (3) conducted as part of the research revealed that almost all respondents (98%) have committed to reducing plastic packaging. Three out of five (60%) have two years or less to meet their voluntary targets, but a quarter (25%) say they are not on track to meet them. Two out of five (40%) identified raw material costs as the biggest obstacle, closely followed by fear that consumers won’t accept changes (39%).

Food manufacturers and retailers fear that packaging changes will make them uncompetitive. Seven out of ten (72%) think that shoppers would not want to pay more for sustainable packaging and nearly two-thirds (65%) think they would not want to sacrifice convenience for sustainability.

Excessive reliance on plastic packaging evident across Europe

The Index analyzed packaging materials in 25 of the most popular supermarkets in six European markets: France, UK, Germany, Italy, Spain, and Poland. France was the least plastic-dependent market with 60% of packaging for food and beverage products on French shelves containing plastic. The UK had the highest proportion of plastic packaging (70%), followed by Spain (67%), Italy (66%), Germany (66%), and Poland (62%).

France was the only country where less than half (49%) of grocery products use plastic as the primary packaging material. This was partly due to the greater presence of fresh produce counters (e.g., bakeries and cheese shops) where products are sold unpackaged, and “organic” sections offering bulk and refill options for items such as cereals and grains.

France’s good performance was also due to the country’s gradual ban on plastic packaging for fresh fruits and vegetables. Even including prepared and processed options (e.g., dried and processed fruits and vegetables), this led to the lowest use of plastic in this category at 44% compared to 78% in the UK. This figure is expected to decrease further before the total ban comes into effect in mid-2026.

Thibault Laumonier, CEO of DS Smith Packaging France, said: “Food companies have committed to replacing plastic packaging, but the reality is that as long as their targets are purely voluntary, we won’t be able to reverse the trend. The EU has set rules for phasing out certain plastics, but too often, stepping up plastic replacement can make companies uncompetitive, creating a disadvantage for early adopters. To accelerate the pace, we need unified global rules in the form of a Global Plastics Treaty. The EU and the US must lead the way by ensuring that the once-in-a-generation opportunity at the Busan summit later this year is not wasted and that avoidable plastics are eradicated in the next decade. Not all plastic can or should be replaced, and not everything can be done today. But the fact is that too much plastic will simply never be recycled, so being tough on waste means legislating it out of our supply chains.”

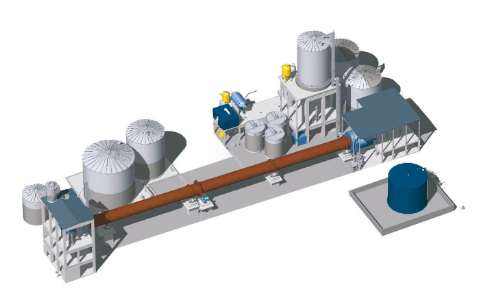

DS Smith estimates that 88% of unnecessary plastic in France can be replaced or significantly reduced by fiber-based alternatives now, and the company continues to invest in finding new solutions. This includes funding a Global Research & Development and Innovation Center, designed to accelerate innovation in packaging and conduct pilot programs with some of the largest consumer goods companies.